Key Benefits

Seamless Integration

Simplified Complexity

Flexibility & Control

Real-Time Optimization

Global Scalability

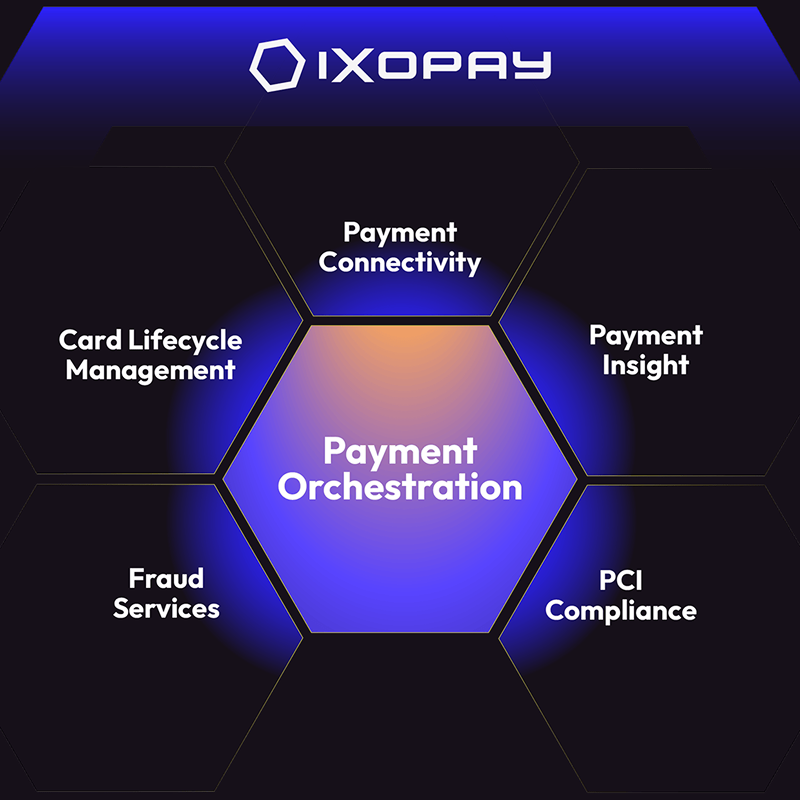

A Single Platform Providing a World of Payment Services

Payment orchestration simplifies the complexities of modern payments by seamlessly integrating all the tools and capabilities your business needs. IXOPAY’s payment orchestration platform streamlines this process, offering extensive connectivity while saving you the time and expense of managing individual connections to various payment providers.

Whether you're onboarding a new provider, enabling additional payment methods, analyzing and consolidating transaction data, or strategically routing payments to preferred providers, payment orchestration offers all these solutions through a single, intuitive interface.

While there are many definitions of Payment Orchestration, enterprise-grade payment orchestration should allow you to:

Route transactions to the best-suited provider

Adopt failover routing for unresponsive gateways or declined transactions

Analyze transaction data across all providers in a single dashboard

Define unified risk rules for all transactions

Unify and report transaction data across all providers

Easily integrate additional systems (CRM, ERP etc.) with your payment stack using a single data format

How IXOPAY Optimizes a Transaction

A single integration to IXOPAY’s Payment Orchestration Platform provides a modular solution to maximize the value of each transaction. At each stage of the transaction, from setting up a new payment connection to post-processing and reporting, our platform has you covered.

Online or In-App Checkout

Online or In-App Checkout

Secure & Tokenize Data

Risk & Transaction Review

Risk & Transaction Review

Route to Preferred PSP

Review Success or Failure Response

Review Success or Failure Response

Forward Purchase to Order Processing/CSM

Reconciliation & Settlement

Reconciliation & Settlement

Report Data Across Accounting Systems

What the Platform Offers

The IXOPAY payment orchestration platform brings independence and flexibility to your online payment management. Using a single API, you can connect to numerous payment service providers (PSPs), acquirers, and processors. You can also connect to the Enterprise Resource Planning System (ERP), Business Intelligence (BI), or third-party software of your choice.

Payment orchestration scales your payments globally. Our connectivity is matched with reporting and post-processing capabilities, so you can analyze and consolidate your transactions in one place.

Smart Transaction Routing

The IXOPAY Smart Routing Engine allows you to define transaction flows for your payments, forward each transaction to the best provider, increase conversions, and reduce transaction fees. You can use various criteria to control the routing decisions: card data, customer data, geographic parameters, risk classification, and a variety of platform and application-specific data.

PCI Compliant Card Vaulting

The IXOPAY Card Vault provides an independent means of storing and tokenizing your customers’ payment data. Our PCI-DSS Level 1, PCI 3DS, and GDPR-compliant solution provide you with greater flexibility, enhanced reliability, and maximum independence from your payment service providers.

Network Tokenization

Network tokens are payment tokens provisioned by the issuing bank and payment networks. They can offer lower transaction costs and higher success rates due to their enhanced security. Each network token transaction is validated using a unique cryptogram to secure the transaction. An embedded account updater automatically refreshes expired or changed card details, resulting in higher approval rates.

Reconciliation & Settlements

The IXOPAY Post Processing Engine automates all your reconciliation and settlement workflows. Optimize the complex process of exchanging and matching transaction data with third-party systems and service providers. The IXOPAY platform consolidates the various disparate formats used by different PSPs and displays them in a centralized and uniform manner.

Customer Profiles

Customer payment profiles in IXOPAY allow end customers to store their payment methods (cards, IBAN, digital wallets etc.) and use them with all your ecommerce sales channels. Furthermore, you can display payment options sorted by customer preference or cost.

Recurring Payments

The IXOPAY platform includes an easy-to-use payment scheduler that covers all the essential functions for recurring payments. If your recurring business model has more complex requirements, IXOPAY is the right complementary solution to work with your marketing and analysis tools.

Fee Management Engine

The Fee Management Engine calculates the external fees and commissions incurred when processing a payment in real-time, no matter how many service providers are involved, ensuring you always have an overview of the associated costs. Stored fees are used to control reconciliation and settlement data automatically and form the basis for optimizing costs with smart routing.

Pay-by-Link

Pay by link is a simple way to sell products and services online. Generate links that customers can use to pay for online purchases of goods and services. You can automatically send links via the IXOPAY platform or send them manually. Email templates can be customized in the platform.

200+ Live Integrations

IXOPAY allows you to connect to 200+ PSPs and 300+ payment methods using a single API. Our connectivity grows each day, while existing adapters are updated and made compatible with the latest API version. Additionally, we provide adapters for eWallets, risk management solutions, ecommerce platforms, enterprise resource systems, customer relationship management software, and more.

Account Updater

Merchants often face issues with outdated card information, which prevents successful payments. Maintain up-to-date payment information for registered clients using IXOPAY’s Account Updater. The Account Updater ensures customer payment continuity and reduces fees related to declined transactions.

Monitoring & Reporting

IXOPAY serves as your central hub for managing payment transactions, offering complete transparency over your payment flows. With built-in reporting tools, you gain instant access to essential KPIs, empowering you to monitor performance with ease. Create custom reports and dashboards, define pivot tables directly, and seamlessly export financial data. Additionally, reports can be automatically transferred to other systems within your environment.

Integration Options

We offer a range of options for integrating elegant, consistent, and customer-friendly payment flows. Whatever your requirements, IXOPAY can meet them: SDKs for mobile apps, hosted payment pages with a dynamic selection of payment methods, server-to-server API for PCI-compliant environments, and our Payment.js library with hosted fields to minimize PCI scope.

Risk Management Engine

Implement your own fraud prevention and risk management strategies. Our platform makes it easy to identify fraudulent transactions and react accordingly. Verification criteria can be configured and combined to form risk profiles that are applied when assessing transactions.

White Label

Our white label platform enables ISOs, PSPs, banks, ISVs, and payment facilitators to grow while saving time and money on development. Our strong technical platform works as the backbone of your payments business, allowing you to focus on business relationships, onboarding new merchants, managing risk, and ensuring regulatory compliance.

Secure Payouts

Businesses facilitating payouts like PSPs, ISOs, and enterprise merchants active in sectors like iGaming, digital advertising, and licensed forex and currency exchanges can use IXOPAY's secure payouts feature to provide complete control over each financial disbursement.

The Benefits of Payment Orchestration

Faster Time-to-Market

Popular PSPs are ready to use immediately, and connecting to a new provider takes just minutes. Easily switch or add PSPs as market demands change. Enjoy faster integrations compared to in-house development, saving time and ensuring flexibility.

Higher Conversion Rates

Offering consumers their desired payment method matters. Many consumers abandon their purchase if their preferred option is unavailable (e.g. BNPL or local payment methods).

Easier Integration with PSPs

All PSPs are integrated via a single API. The payment orchestrator maintains this interface, meaning there is no overhead on the part of merchant when individual PSPs change their interface.

Consolidated Reporting and Analytics

Easily analyze transactions from multiple PSPs within a single platform and generate comprehensive reports with any data you need. Our payment orchestration platform consolidates transaction data across all PSPs, bringing clarity and efficiency to your payment processes.

Easier Integration with Third-Party Systems

IXOPAY’s platform consolidates transaction data across PSPs using a unified format. This data seamlessly integrates with systems for order management, customer relationship management, shipping, accounting, and more, ensuring efficient and cohesive operations.

Focus on Your Business

Focus on what you do best, and leave payment integrations to the experts. Increase efficiency and eliminate costly overhead from maintaining and updating payment integrations.

Higher Authorization Rates

Routing transactions to PSPs with local acquiring capabilities typically results in higher authorization rates. Depending on circumstances, increases in the authorization rate can reach double digits.

Increased Operational Efficiency

Automate time-consuming tasks and concentrate on your core business. With only a single interface to maintain, the effort required to process transaction data reduces accounting overhead significantly.

Recover Sales with Fallback Options

Automatically route transactions to an alternative provider if the merchant’s preferred PSP is temporarily unavailable. Merchants can also easily pivot to an alternative provider if their PSP goes out of business or is acquired by a new owner with different priorities.