How do you manage a payment ecosystem that involves multiple entities and different jurisdictions?

IXOPAY has experience of working with enterprise-level clients and white labellers. A major issue that these companies–those with multiple holdings or large portfolios–face is the compartmentation of their payment processing. What do we mean by compartmentalizing? In this sense it is when each entity or subsidiary has their own payment system which is not linked to the parent company. This makes it very difficult to get a complete overview of the payments landscape and how each subdivision is performing. As not only are their payment processes kept separate but the act of consolidating the information can be near impossible as each payment service provider provides data in their own unique way.

How do payment processes become inefficient?

This is not a unique situation. Enterprise merchants tend to grow on the acquisition and merging of other organizations and corporations. This absorption means that they are inheriting a payment set up that was already in place. One that was probably sufficient at its job, and as the old adage goes ‘If it ain't broke, don’t fix it.’ With this short-term mindset the payments process becomes fragmented. This complicated setup means that the enterprise will have to juggle multiple payment landscapes and have an incomplete view. This mish mash of payments makes it unruly to manage and becomes a financial drain as there are multiple gateways that need to be maintained and built. It also means that the merchant is unlikely to be achieving the best deal per transaction as the volume is spread out across multiple providers and gateways.

How can a payment orchestration platform streamline the payment ecosystem for enterprise merchants?

By centralizing payments, corporations will have an accurate view of all their transactions and payouts that are spread across their multiple holdings. A payment orchestration platform has the flexibility to monitor and show a complete overview across all businesses in real time, or it can zoom in and focus on one entity. This allows users to choose how they wish to see their data.

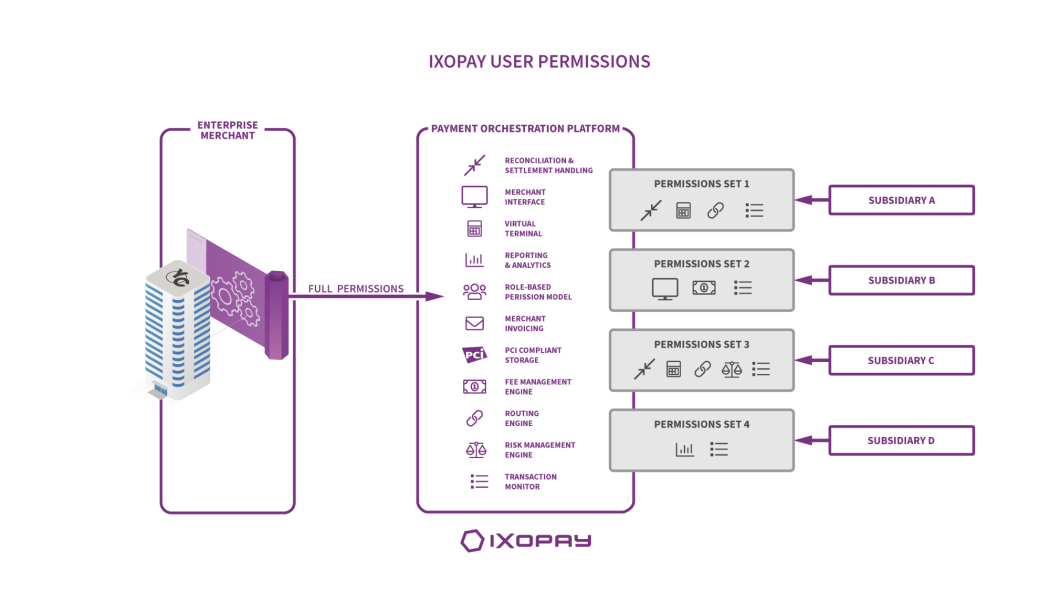

However, just because all the data is stored in one place does not mean that everyone will have access to it. The admin user will give permissions to others, so if you do not want your users seeing how other entities within the company perform, you can set permissions so that they only see the transactions that apply to them. Just because all of your data is in one place does not mean that everyone has access to all of it.

Why should an established enterprise switch it's payments to a Payment Orchestration Platform?

Many businesses are wary about making a switch especially if they have a payment set up that is getting the job done. Although the benefits are clear many worry about the temporary upheaval of migrating their payments to a payment orchestration platform and once payment orchestration is in place it can simply grow with your business. Cut out the complications by implementing a clear and payment set up.

Enterprise merchants should centralize their connections in order to get the best processing rates

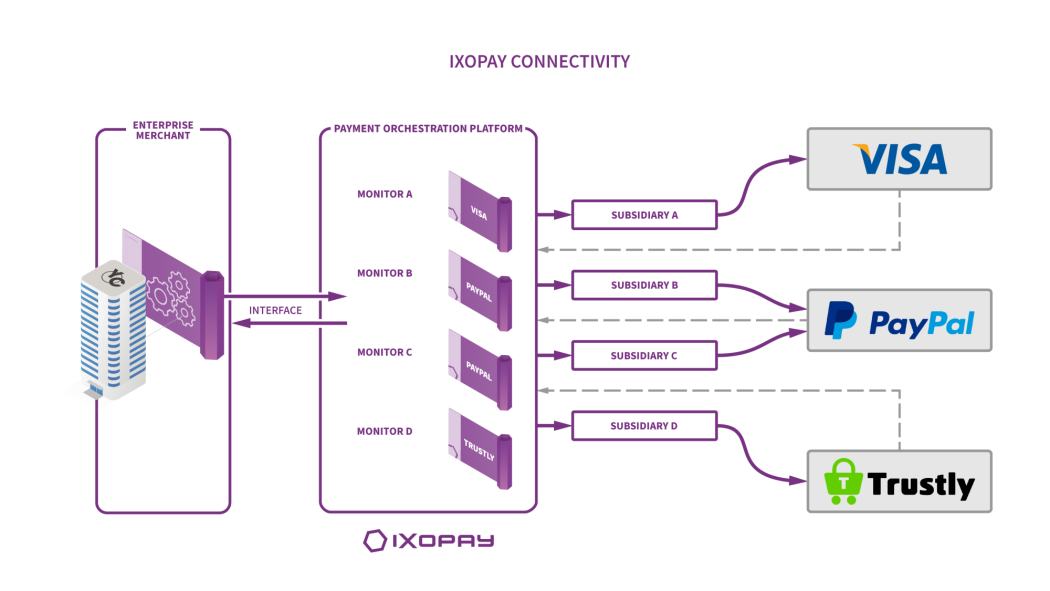

One of the most important benefits of a payment orchestration platform is connectivity. Connectivity is a driving force behind increased conversion rates as it enables businesses to tailor their payment options to their exact audience. It is important for large corporations with multiple businesses to be connected because each of their interests may have a different demographic. A payment orchestration platform allows them to connect, through one API, to local payment methods that are popular with the audience of one company and others which are popular with another. This tailoring and personalization ensure that they are selecting the right payment methods for the markets that they sell in, increasing the chance that someone will complete a transaction.

Choose which payment methods you want to use for each of your businesses. From one API you can add payment methods and assign them to the entities of your choice. By centralizing your payments, you can negotiate better transaction rates with providers as a payment method may be suitable for one or more entities, which would then provide a higher combined transaction rate which could lower your processing fees.

With greater connectivity, you will also be able to route transactions and use cascading and fallback.

How can Post Processing with a payment orchestration platform ease data aggregation?

What is post processing and how does it work with payments? Post processing is the aggregation of payments information for reconciliation and settlement purposes. This data is taken from the various payment providers and analyzed by financial controllers in order to make sure that there are no errors. As mentioned before, the reconciliation of transactions with payment service providers presents several challenges to eCommerce enterprises, as different service providers handle this process in different ways. A payment orchestration platform standardizes the reconciliation process and any resulting conflicts across the board, independent of your payment service providers and payment methods. Thus making it easier for personnel to analyse and work with the data.

A market leading payment orchestration platform should be able to provide a reconciliation overview that collates conflicts, such as incorrectly calculated transaction fees, missing reconciliation data and unidentified transactions clearly. It can easily resolve all identified conflicts across all business holdings from within the interface, drastically simplifying this task for your employees.

IXOPAY is not a standard payment orchestration platform, its intuitive and flexible design makes it the perfect partner for large companies who want the payments of their business centralized, in order to benefit from unlimited connectivity and aggregated payment data. The flexible and scalable architecture gives users access to the full payment lifecycle from one API. Our sales team would be happy to discuss any queries you may have and to assist you with your payment processing challenges.

About IXOPAY

IXOPAY is a payments orchestration platform enabling independent, flexible and global payment processing. As a highly scalable and PCI-DSS certified “fintech enabler”, IXOPAY fulfills the needs of large merchants as well as those of “white label” clients: payment service providers (PSPs), acquirers and independent sales organizations (ISOs). The modern, easily extendable architecture offers smart transaction routing & cascading, state-of-the-art risk & fraud management, fully automated reconciliation and settlements processing, comprehensive reporting as well as plugin-based integration of acquirers, payment service providers and alternative payment methods (APMs).

IXOPAY is part of the IXOLIT Group, founded in Vienna, Austria in 2001. With local entities in Austria and the USA, IXOLIT supports national and international customers across various industry verticals. The owner-led and -financed company has grown from 2 to more than 65 employees and is focused on building innovative solutions for eCommerce.

Please find more information about IXOPAY here: https://www.ixopay.com