Online payment innovation has grown in the last ten years, and the landscape has changed drastically. Merchants who sell goods or services online are under pressure from consumers to keep their payment solution up to date and accessible to as many people as possible. How can merchants keep up with payment trends and keep their process flow running smoothly when they are working with multiple payment providers?

Don't let your payment implementation stagnate your business

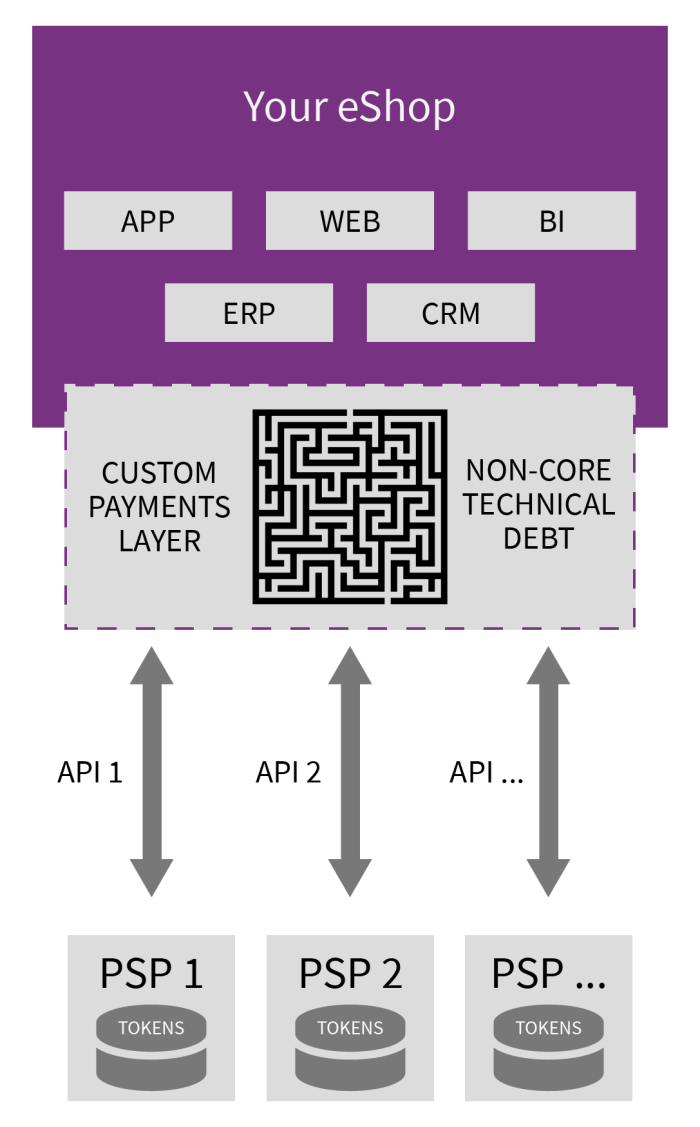

Often when a business is first starting to sell online, they use just one or two payment service providers. With these providers they need to create a payment connection, the connection allows the merchant to process their payments from their chosen provider. Integrating these connections is time consuming and costly, and when the business grows additional processing power is needed. However, in order to use additional payment service providers, further connections need to be integrated. Each of these unique integrations requires a custom build. This approach lacks forward-thinking and leads to the creation of architecture that is inflexible, increasingly expensive to maintain, time-consuming, and costly.

Flexible payment solutions for growing enterprises

In the early days of online shopping, the majority of purchases were done via card, so having one or two payment processors, although not recommended, would not have been as restrictive. However with the increased convenience of online purchasing and the ability to reach potential customers in different countries, the volume of transactions has increased and the need for more adaptable payments has grown exponentially. If a business is using only one or two payment service providers for all of their transactions, at peak times, the payment service providers may struggle to cope causing payment failure and slow performance times. By using a payment management system, businesses can add as many payment providers (offering domestic and international payment methods) as they wish and because payment data is stored in a third-party card vault they can switch providers without losing any information. This gives companies the flexibility they need to grow their business and reach out to new customers.

How to manage reconciliation data from multiple payment providers?

The reconciliation of transactions with payment service providers presents a number of challenges to eCommerce enterprises. This is because different service providers handle this process in different ways. For instance, one service provider may provide reconciliation data within seconds, whereas it may take several hours or days for another to provide the same data. Then there is the issue of the actual data, different providers and different payment methods give different formats and the actual information itself can also vary. This is most commonly seen with different payment methods ie. an open banking payment method is likely to give you different data compared to a prepaid card service.

If you have built connections to multiple payment service providers or have multiple acquirers, you will receive your reconciliation data in multiple ways, at different times, and in different formats. This will make it very difficult for administrative staff who need to collate and analyze all of the data. How can you make meaningful comparisons when the data you are working with, is not comparable?

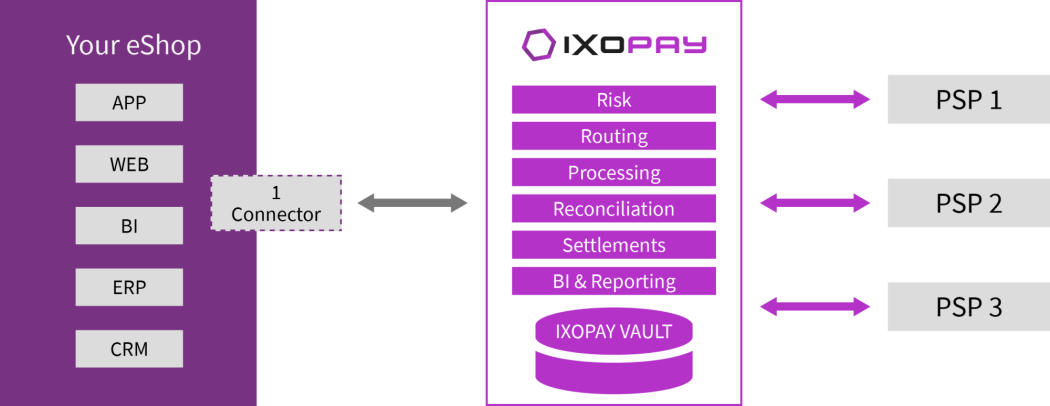

By using a payment management system, like IXOPAY, you are able to standardize the reconciliation process and any resulting conflicts across all your payment data, regardless of the payment service providers used and payment methods. The automated reconciliation of data gives users a complete overview and collates conflicts, such as incorrectly calculated transaction fees, missing reconciliation data, and unidentified transactions in a clear and structured manner. Any identified errors can be easily resolved from within the interface, drastically simplifying this task and reducing the time needed for your employees.

Consolidate your transaction flow with a payment management system

The idea of payment orchestration is not a new one, and providers have been around for over 15 years. However, now with online shopping becoming a much more global enterprise and the increase in payments innovation, it is now more essential than ever. Merchants are optimizing their payments infrastructure and investing in sustainable payment solutions as the risk of not doing so is too high. A payment management system solves the most common challenges faced by merchants:

Fractured payment processes and lack of flexibility stalling growth potential

Payment processors unable to cope with high-volume transaction demand leading to slow performance and increase in failed payments

Lack of clarity across payment processes

Continuous operational and IT maintenance costs of existing acquirer and PSP integrations

Payment orchestration allows for transactions to be processed by multiple payment providers via simple plugins, this flexibility lets users add and switch providers with ease, knowing their payment data is stored in a third-party GDPR vault. All payment data is kept within the platform, which unifies it allowing for streamlined analysis. This reduces administration and manual processing efforts of financial personnel and improves the operational productivity and efficiency.

Build your optimal payment strategy with IXOPAY!

Get in touchAbout IXOPAY

IXOPAY is a payments orchestration platform enabling independent, flexible and global payment processing. As a highly scalable and PCI-DSS certified “fintech enabler”, IXOPAY fulfills the needs of large merchants as well as those of “white label” clients: payment service providers (PSPs), acquirers and independent sales organizations (ISOs). The modern, easily extendable architecture offers smart transaction routing & cascading, state-of-the-art risk & fraud management, fully automated reconciliation and settlements processing, comprehensive reporting as well as plugin-based integration of acquirers, payment service providers and alternative payment methods (APMs).

IXOPAY is part of the IXOLIT Group, founded in Vienna, Austria in 2001. With local entities in Austria and the USA, IXOLIT supports national and international customers across various industry verticals. The owner-led and -financed company has grown from 2 to more than 65 employees and is focused on building innovative solutions for eCommerce.

Please find more information about IXOPAY here: https://www.ixopay.com