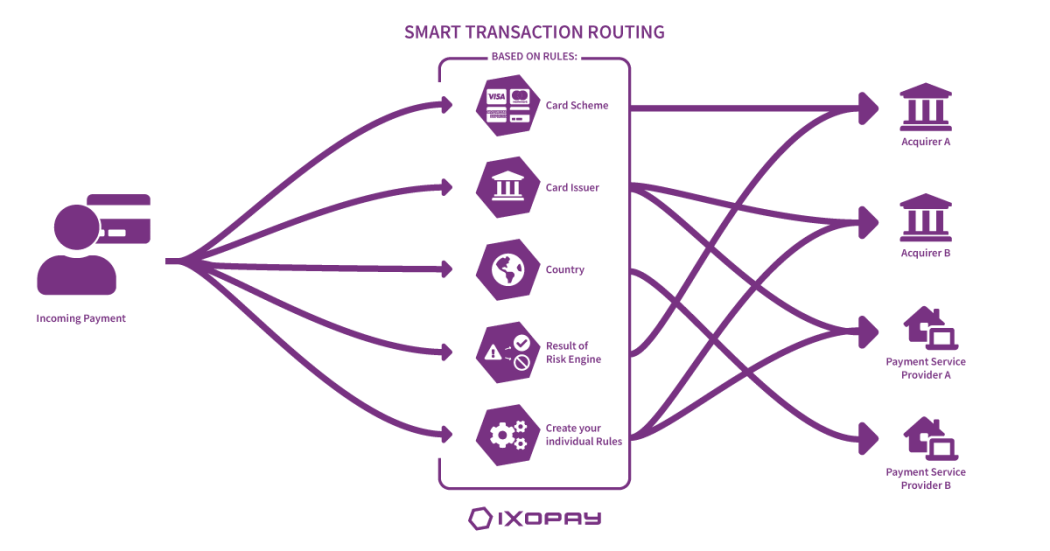

Transaction routing is a feature of a multi-provider setup and allows merchants to determine which provider should process particular transactions. Transaction routing can help merchants improve their authorization rates and reduce fees, typically by routing to a local payments provider. The IXOPAY routing engine is flexible and supports:

Cascaded transactions

Geographical optimization

Risk based routing

Fallback routing

How does transaction routing work?

What are the benefits of transaction routing?

How does a payment orchestration platform improve transaction routing?